Stop Posting & Praying! The 3-Step Affiliate Hack Printing $$ (No Audience Needed)

1. Introduction

Having multiple sources of income is crucial for financial stability and security.

Relying on a single income stream can be risky, as job loss or economic downturns can significantly impact your finances.

Diversifying your income through side gigs, investments, or passive income streams helps mitigate this risk.

It provides a safety net, allowing you to weather unexpected challenges more easily.

Additionally, multiple income sources can accelerate wealth building and enable you to achieve financial goals faster.

Ultimately, diversifying your income not only enhances your financial resilience but also offers greater freedom and flexibility in your life choices.

2. Trend Analysis

The latest fear and greed index

The Fear and Greed Index measures market sentiment, ranging from extreme fear to extreme greed, based on factors like volatility, stock price momentum, and demand for safe-haven assets.

- Extreme Fear: Indicates heightened investor caution, often signalling potential buying opportunities as prices may be undervalued.

- Extreme Greed: Reflects excessive optimism, which can lead to overvalued assets and potential market corrections.

The index helps investors gauge emotional extremes in the market, aiding in contrarian decision-making.

While useful as a sentiment indicator, it’s not predictive and should complement fundamental and technical analysis to avoid reacting solely to market emotions.

The index now is 30 and is considered FEAR

The 10-Year Treasury Minus 2-Year Treasury Yield Spread (10Y-2Y)

It reflects the difference between long-term and short-term U.S.

Treasury yields, serving as a key economic indicator.

A positive spread (normal yield curve) signals economic growth expectations, while a negative spread (inverted yield curve) often predicts recessions, typically 6-24 months ahead.

It is closely monitored by investors and policymakers to assess future economic conditions and monetary policy impacts.

An inverted curve suggests economic pessimism and potential rate cuts, while a steep curve indicates confidence in growth.

The current 10Y – 2U yield spread is at 0.51 which is relatively healthy

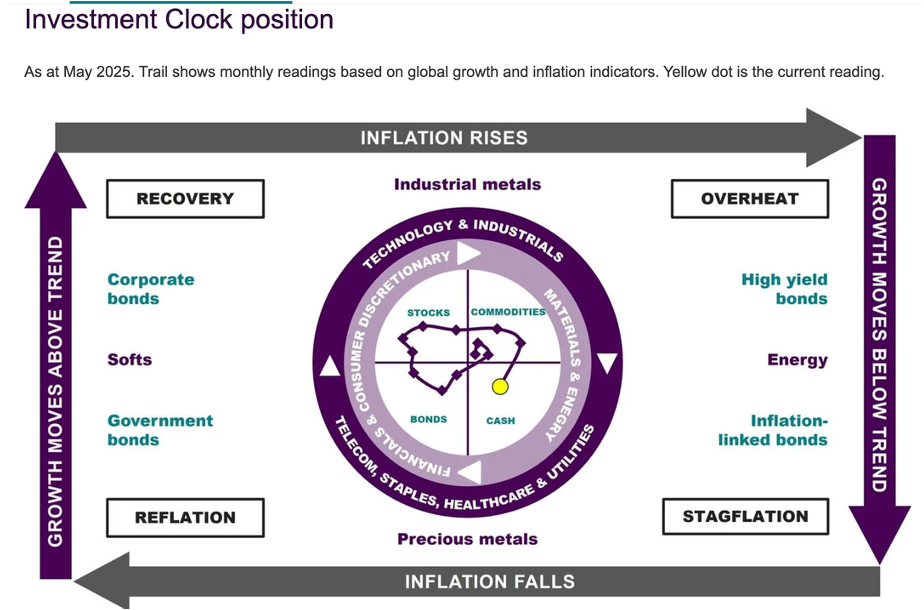

The Investment Clock

It is a framework linking economic cycles to asset performance, helping investors align strategies with macroeconomic conditions.

Its four phases—Recovery, Overheat, Stagflation, and Reflation—are based on growth (GDP) and inflation trends.

· Recovery: Low inflation and rising growth favour equities and risk assets.

· Overheat: Rising growth and inflation benefit commodities but pressure bonds.

· Stagflation: High inflation and falling growth make defensive assets like bonds and cash attractive.

· Reflation: Falling growth and inflation favour bonds and safe-haven assets.

The current market condition is low in growth movement with increased chance of STAGFLATION

3. Weekly Tips (for multiple sources of income)

Freelance AI Consulting: Offer your expertise to businesses looking to implement AI solutions. This could include strategy development, model training, or data analysis.

By diversifying your efforts in these areas, you can create a sustainable income stream related to AI.

4. Weekly Inspiration for multiple source of income

"Too many people spend money they earned to buy things they don’t want to impress people they don’t like."

— Will Rogers

This weekly inspiration quote reflect the importance of financial discipline, personal growth, and aligning money with one’s values and goals.

5. Today’s Headlines

Stop Posting & Praying! The 3-Step Affiliate Hack Printing $$ (No Audience Needed)

This article outlines a simple, effective 3-part system designed to turn views into commissions, even for those starting with zero followers.

It emphasizes the importance of capturing attention through engaging short-form content, creating a value funnel to build an email list, and nurturing leads with personalized follow-ups.

The guide provides practical tools and strategies for each step, encouraging readers to take action by posting content, building landing pages, and writing follow-up emails.

With a focus on relationship-building in affiliate marketing, this system aims to help anyone establish a scalable income stream quickly and efficiently.

6. Final Takeaways

The key to transforming views into commissions lies in implementing a structured approach.

By capturing attention with compelling short-form content, creating a value-driven funnel to build an email list, and following up with personalized communications, you can effectively engage your audience.

Remember, even with zero followers, consistent effort and strategic content can lead to significant income.

Focus on building relationships rather than just sharing links, and leverage tools that streamline your process.

With dedication and the right system, you can establish a scalable and profitable affiliate marketing venture.

Start today and watch your income grow!

7. Q&A Sessions

Please submit your questions on the topic of “Multiple sources of income” by replying to this email, and we will be answering them here.