How To Become a Self-Made Millionaire on a Low Salary, According To Humphrey Yang

1. Introduction

Having multiple sources of income is crucial for financial stability and security.

Relying on a single income stream can be risky, as job loss or economic downturns can significantly impact your finances.

Diversifying your income through side gigs, investments, or passive income streams helps mitigate this risk.

It provides a safety net, allowing you to weather unexpected challenges more easily.

Additionally, multiple income sources can accelerate wealth building and enable you to achieve financial goals faster.

Ultimately, diversifying your income not only enhances your financial resilience but also offers greater freedom and flexibility in your life choices.

2. Trend Analysis

The latest fear and greed index

The Fear and Greed Index measures market sentiment, ranging from extreme fear to extreme greed, based on factors like volatility, stock price momentum, and demand for safe-haven assets.

- Extreme Fear: Indicates heightened investor caution, often signalling potential buying opportunities as prices may be undervalued.

- Extreme Greed: Reflects excessive optimism, which can lead to overvalued assets and potential market corrections.

The index helps investors gauge emotional extremes in the market, aiding in contrarian decision-making.

While useful as a sentiment indicator, it’s not predictive and should complement fundamental and technical analysis to avoid reacting solely to market emotions.

The index now is 30 and is considered FEAR

The 10-Year Treasury Minus 2-Year Treasury Yield Spread(10Y-2Y)

It reflects the difference between long-term and short-term U.S.

Treasury yields, serving as a key economic indicator.

A positive spread (normal yield curve) signals economic growth expectations, while a negative spread (inverted yield curve) often predicts recessions, typically 6-24 months ahead.

It is closely monitored by investors and policymakers to assess future economic conditions and monetary policy impacts.

An inverted curve suggests economic pessimism and potential rate cuts, while a steep curve indicates confidence in growth.

The current 10Y – 2U yield spread is at 0.48 which is relatively healthy

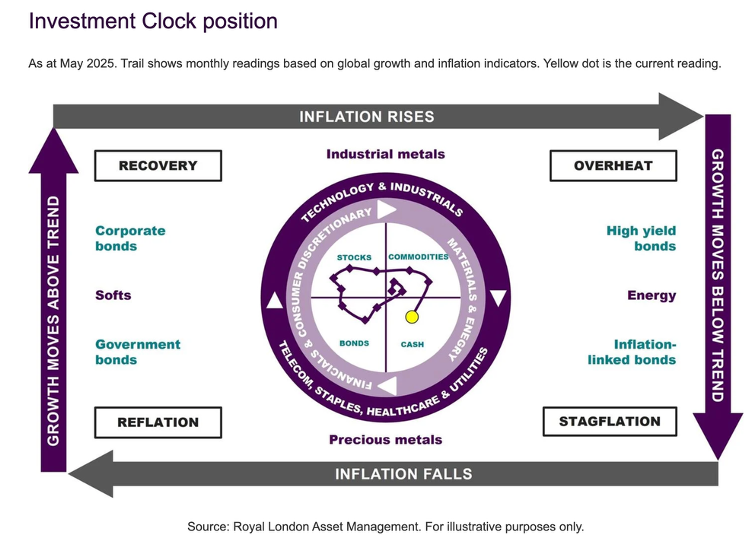

The Investment Clock

It is a framework linking economic cycles to asset performance, helping investors align strategies with macroeconomic conditions.

Its four phases—Recovery, Overheat, Stagflation, and Reflation—are based on growth (GDP) and inflation trends.

Recovery: Low inflation and rising growth favour equities and risk assets.

Overheat: Rising growth and inflation benefit commodities but pressure bonds.

Stagflation: High inflation and falling growth make defensive assets like bonds and cash attractive.

Reflation: Falling growth and inflation favour bonds and safe-haven assets.

The current market condition is low in growth movement with increased chance of STAGFLATION

3. Weekly Tips (for multiple sources of income)

Investing:

Build wealth through stocks, bonds, or real estate.

Research investment strategies and diversify your portfolio to create passive income that grows over time, enhancing your financial stability.

4. Weekly Inspiration for Multiple Sources of income

Dame Anita Roddick: "If you think you’re too small to make a difference, try sleeping with a mosquito."

5. Today’s Headline

Mastering Wealth: Humphrey Yang's Guide to Becoming a Millionaire on a Low Salary

Humphrey Yang shares his four essential pillars for building wealth, proving that a low salary doesn’t have to limit your financial success.

6. Final Takeaways

The key to becoming a self-made millionaire on a low salary lies in adopting a mindset focused on frugality, strategic investing, and diversifying income streams.

Humphrey Yang emphasizes that every dollar matters, encouraging individuals to prioritize savings and make informed investment choices early.

By understanding the power of compound interest and the importance of time, aspiring millionaires can significantly grow their wealth over the years.

Ultimately, persistence and a proactive approach to personal finance can transform even modest incomes into substantial fortunes, proving that financial success is achievable for anyone willing to commit to smart financial practices.

7. Q&A

Please submit your questions on the topic of “Multiple Sources of Income” by replying to this email, and we will be answering them here.