17 Genius Ways to Make Money With AI That You Wish You Knew Sooner!

1. Introduction

In today's volatile economy, diversifying income streams has become a key strategy for achieving financial stability and independence. However, many individuals fall into common traps that can derail their efforts and lead to frustration.

From "shiny object syndrome" to unrealistic expectations, these pitfalls can prevent you from fully capitalizing on your ventures.

Understanding these mistakes is crucial for anyone looking to expand their financial horizons.

In this guide, we will explore the most frequent missteps people make when diversifying their income and provide actionable insights to help you navigate the journey toward multiple revenue sources successfully.

2. Trend Analysis

The latest fear and greed index

The Fear and Greed Index measures market sentiment, ranging from extreme fear to extreme greed, based on factors like volatility, stock price momentum, and demand for safe-haven assets.

Extreme Fear: Indicates heightened investor caution, often signalling potential buying opportunities as prices may be undervalued.

Extreme Greed: Reflects excessive optimism, which can lead to overvalued assets and potential market corrections.

The index helps investors gauge emotional extremes in the market, aiding in contrarian decision-making.

While useful as a sentiment indicator, it’s not predictive and should complement fundamental and technical analysis to avoid reacting solely to market emotions.

The index now is 54 and is considered neutral

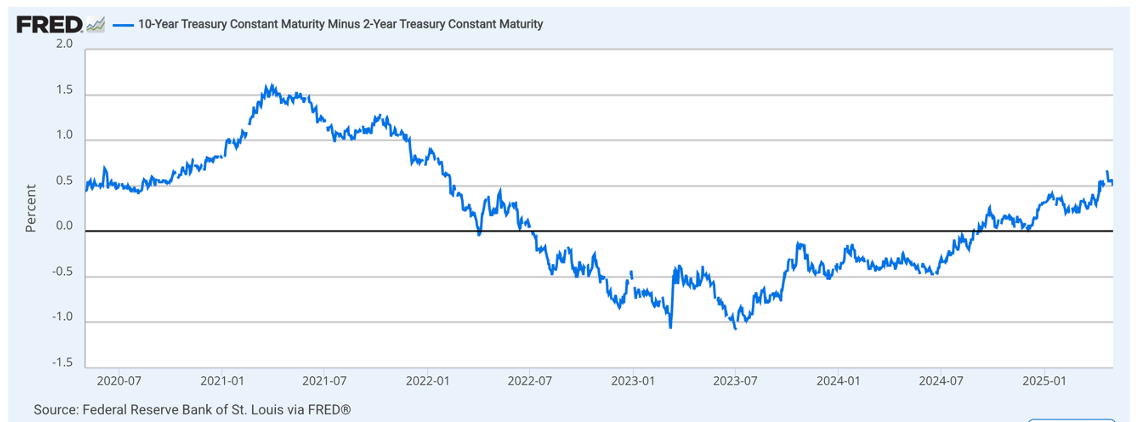

The 10-Year Treasury Minus 2-Year Treasury Yield Spread(10Y-2Y)

It reflects the difference between long-term and short-term U.S.

Treasury yields, serving as a key economic indicator.

A positive spread (normal yield curve) signals economic growth expectations, while a negative spread (inverted yield curve) often predicts recessions, typically 6-24 months ahead.

It is closely monitored by investors and policymakers to assess future economic conditions and monetary policy impacts.

An inverted curve suggests economic pessimism and potential rate cuts, while a steep curve indicates confidence in growth.

The current 10Y – 2U yield spread is at 0.5 which is relatively healthy

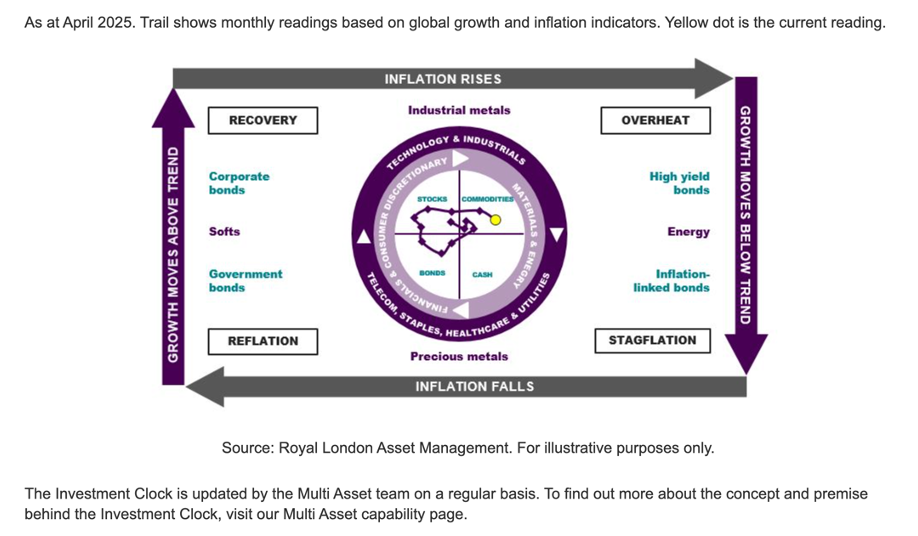

The Investment Clock

It is a framework linking economic cycles to asset performance, helping investors align strategies with macroeconomic conditions.

Its four phases—Recovery, Overheat, Stagflation, and Reflation—are based on growth (GDP) and inflation trends.

Recovery: Low inflation and rising growth favour equities and risk assets.

Overheat: Rising growth and inflation benefit commodities but pressure bonds.

Stagflation: High inflation and falling growth make defensive assets like bonds and cash attractive.

Reflation: Falling growth and inflation favour bonds and safe-haven assets.

The current market condition is overheat with increased chance of inflation

3. Weekly Tips (for multiple sources of income)

Start a Side Hustle

Use your skills to freelance, consult, or start a small business (e.g., graphic design, tutoring, or writing).

4. Weekly Inspiration for multiple source of income

"It’s not about how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for."

— Robert Kiyosaki

5. Today’s Headlines

Discover how AI is revolutionizing industries with 17 innovative ways to generate income, from chatbots to graphic design, and start your journey to financial success today!

How To Make Money Using AI: 17 Ideas (2025)

6. Final Takeaways

AI is transforming how we work and create, opening up endless opportunities to generate income across industries.

From developing AI-powered software and chatbots to creating digital art, content, or predictive financial models, AI offers tools to automate tasks and enhance productivity.

Whether you’re an entrepreneur, freelancer, or side hustler, leveraging AI tools like ChatGPT, Jasper, and Midjourney can help you scale your efforts and tap into growing markets.

The key is identifying inefficiencies, solving pain points, and combining AI’s capabilities with your unique skills.

With the AI market continually expanding, now is the perfect time to capitalize on its potential.

7. Q&A Sessions

Please submit your questions on the topic of “Multiple sources of income” and we would be answering them here.